How To Fix Your Credit Score in 2022

You may want to increase your credit score for numerous reasons. By obtaining a higher score, you will be able to get lower interest rates, which will make borrowing money more affordable. In addition to the potential for higher limits on your existing credit cards, boosting your score may also make it more likely you will be approved for major purchases, such as a vehicle or home.

850credit is one of the best sites that provide you step by step guide to increase your score. There are many ways how to boost your credit score fast so that it will take less time for you to achieve the higher scores that you need to reap the benefits of a good credit rating. We have the expertise that you need to deal with any situation presented by creditors, collectors, and credit bureaus. Feel free to read our customers’ reviews

Credit scores are important to every person with a bank account. A high score can help you get better interest rates and lower monthly payments on your loans, as well as qualify for more favorable terms with other types of credit.

On the flip side, low or poor credit can lead to higher costs and difficulty when it comes time to borrow money – not something anyone wants. With that in mind, we would like to share some factors that affect your score so you know what’s at stake!

Get started today with a FREE Credit Repair Consultation, or call us at (312) 978-7527

5 Factors How To Increase Your Credit Score

1. Payment History

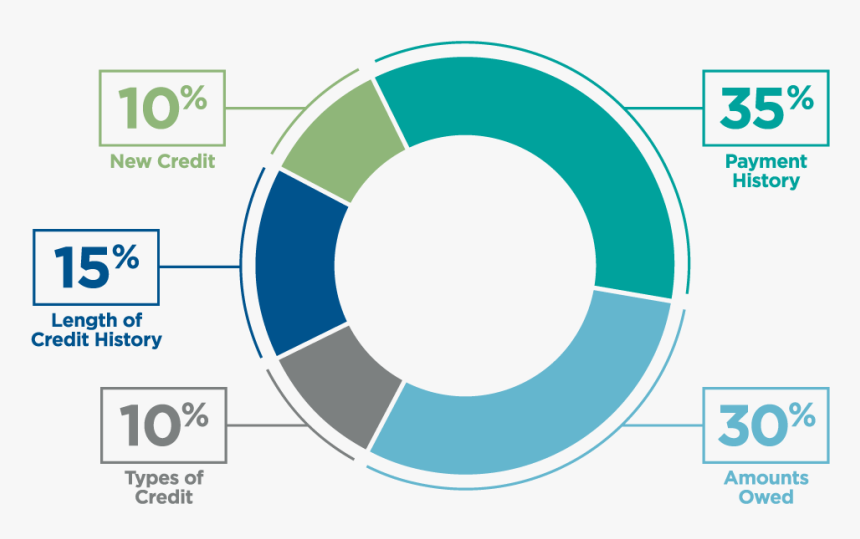

Payment history is one of the most important factors in a score, and it accounts for about 35% of the total. According to a study from FICO, consumers who make late payments on their bills are twice as likely to declare bankruptcy within 24 months.

Late payment behavior also influences how long you’ll stay in debt, with those who made late or missed payments remaining in debt longer than those who don’t miss payments at all.

In general, it’s best not to be late with your payments if you can help it — but what happens when life gets hectic?

Avoiding late fees by contacting creditors ahead of time and setting up a payment plan will help them understand your situation and usually lead to a more lenient policy. Being prepared ahead of time is key, as it will help you make sure your bills are paid on time and that late fee doesn’t cause too much damage.

2. Personal Debt

Your score can be deeply affected by your total debt load, with a higher amount associated with lower scores, all other factors being equal. One study found that increasing credit card balances from $2,500-$5,000 was linked to approximately 30 point deductions from a person’s average score of 723.

In general, it’s best not to let your debts get out of control or allow anyone’s bill to accumulate too high – even if the minimum payment may seem within reason for paying at first glance!

3. Length Of Credit History

The longer your credit history, the better your score will be. This is because creditors see you as less risky if you’ve had a good payment record for a long time. This factor accounts for about 15% of your score. The length of your history is determined by both the age of your oldest account and the average age of all your accounts.

4. Types Of Credit Used

The types of credit you have also played a role in your score, with different types weighted differently. One example: A mortgage is considered a more significant loan than a credit card, so it would have more impact on your score. This factor accounts for about 10% of your overall score.

5. Recent Credit Behavior

Recent credit behavior accounts for about 10% of your score. This factor is determined by the number of times lenders have viewed your report recently, as well as how often you’ve applied for new credit. The more recent that activity has occurred, the less impact it will have on your score.

Make sure that you check your credit reports at least once a year to see how they’re looking and to ensure there’s no incorrect information affecting your score negatively. If any negative marks are listed, contact the creditor immediately to resolve or dispute them. You’ll want to take care of these items so you don’t experience unnecessary damage to your score!

5 Easy Steps How To Fix Your Credit

1. Don’t Open Any New Lines Of Credit

Don’t apply for a loan, increase your credit card limit, etc. without first talking to creditors about items on your report that are incorrect or need to be updated. Once you have an updated version of your credit, you won’t want to risk doing anything that could hurt it!

Say, for instance, you have a score of 680 and want to increase it to 720. You can easily achieve this by doing the following:

1) Pay your bills on time every month for 6 months

2) Reduce the amount of debt you owe

3) Add 2 years to your credit history

4) Have at least 1 credit card and keep the balance low

5) Don’t open any new lines of credit

If you follow these simple steps, you’ll be able to raise your score in no time!

2. Review Your Reports To See What Needs Fixing

Your score is calculated by looking at the information contained within your three reports from Experian, TransUnion, and Equifax. You can get one free copy of each every year through AnnualCreditReport.com – simply request them from one bureau each year so you don’t overwhelm yourself with requests at once!

3. Dispute Errors On Your Reports

While you can’t get negative information removed from your report, you can dispute the errors that may be listed. If an item has been incorrectly reported to a bureau, it will be included in all three of your reports and should be fixed quickly.

For example, if you have a credit card that is past due and goes to collections, but it’s paid in full, this will hurt your score. To dispute the inaccuracy of this information with the bureau reporting falsely, you can file a dispute online or by mail.

4. Pay Off Debts In Collections

If a creditor is unable to reclaim their money after taking steps such as showing up at your house or calling your family members – they have the right to turn the debt over to a collection agency. That collection account could damage your score without being removed for 7 years! Take care of this ASAP so that doesn’t happen.

How to do it? Start by negotiating with the creditor. Let them know that you want to work out a payment plan, and be prepared to offer a lump sum of money if possible. You could also try a debt consolidation loan or credit counseling to get help.

5. Pay Down High Balances

Your interest rates are determined by how much debt you’re carrying – so paying down your balances will help you save money in the long run and improve your score. Try to keep your credit utilization ratio (the percentage of your available credit that you’re using) at 30% or below – that’s a good rule of thumb to follow.

Like, for example, if you have a credit card with a $1,000 limit and you owe $700, you will be using 70 percent of your available credit. If this is the only card you are using well…that’s not so good! Try to pay off that balance as soon as possible so that you’re only making minimum payments on one card instead of multiple cards.

Doing these five things can help your score improve over time! Once your scores are in the acceptable range for lending institutions, it should be much easier for you to take out loans or lines of credit. You can even make shopping around for low-interest rates easier by requesting free copies of your reports from AnnualCreditReport.com once every 4 months – this way you can be on top of your credit game at all times!

If you want an easy way to fix your score, try following these 5 steps. If you’re looking for more information on how to repair bad credit, check out this blog post. Your old ways of thinking about fixing your credit could be holding you back from getting the results that you really want! Let’s look at five factors that are essential in increasing your score by doing things like paying off debt or even just improving a few items on our report so it doesn’t have such a dramatic impact on our scores. It might seem daunting but with time and effort, anyone can improve their result–and if we work together I know we can get there too!

Get started today with a FREE Credit Repair Consultation, or call us at (312) 978-7527